The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company. The contribution margin may also be expressed as fixed costs plus the amount of profit.

Ready to Level Up Your Career?

Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions. Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & how to do bank reconciliation in xero development (R&D), and depreciation of equipment. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin.

Create a Free Account and Ask Any Financial Question

You work it out by dividing your contribution margin by the number of hours worked on any given machine. However, they will play an important part in calculating the net income formula. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins. Fixed and variable costs are expenses your company accrues from operating the business. Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs.

Contribution Margin Ratio FAQs

Many companies use metrics like the contribution margin and the contribution margin ratio to help decide if they should keep selling various products and services. For example, if a company sells a product that has a positive contribution margin, the product is making enough money to cover its share of fixed costs for the company. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold.

- The contribution margin may also be expressed as a percentage of sales.

- Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid.

- However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

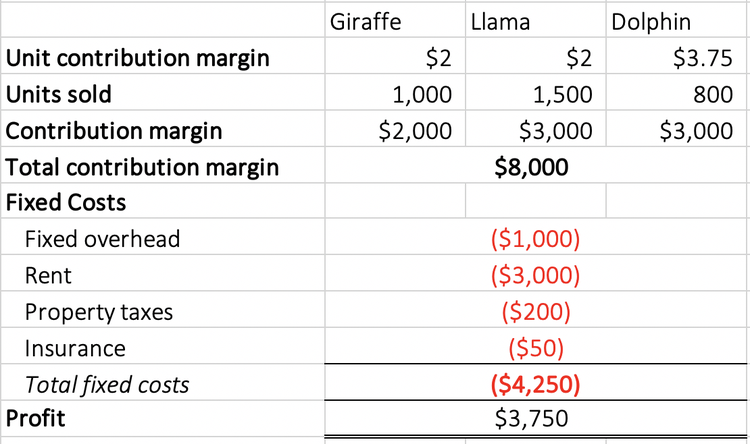

Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. The following examples show how to calculate contribution margin in different ways. You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products.

Contribution Margin for Overall Business in Dollars

Once those values are set, you can create the perfect schedule the first time through…without going over your labor budget. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis. With that all being said, it is quite obvious why it is worth learning the contribution margin formula. Should the product be viewed as more of a “loss leader” or a “marketing” expense? You need to fill in the following inputs to calculate the contribution margin using this calculator.

We’ll start with a simplified profit and loss statement for Company A. Further, it is impossible for you to determine the number of units that you must sell to cover all your costs or generate profit. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. This means Dobson books company would either have to reduce its fixed expenses by $30,000.

Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends. Another common example of a fixed cost is the rent paid for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold. Let’s say your business sold $2,000,000 in product during the first quarter of the year. The interesting thing about contribution margin ratio is that you can perform the calculation anytime to achieve a unique view into your business.